Seattle Housing Market Update: Prices Rise Amid Mixed Conditions

The Seattle-area housing market remains active, though its pace has shifted from the pandemic’s frenzy to a more measured, yet still competitive environment. Recent data from the Northwest Multiple Listing Service (NWMLS) highlights both rising home prices and shifting buyer-seller dynamics across King, Snohomish, Pierce, and Kitsap counties.

Single-Family Homes: Limited Supply Driving Prices Up

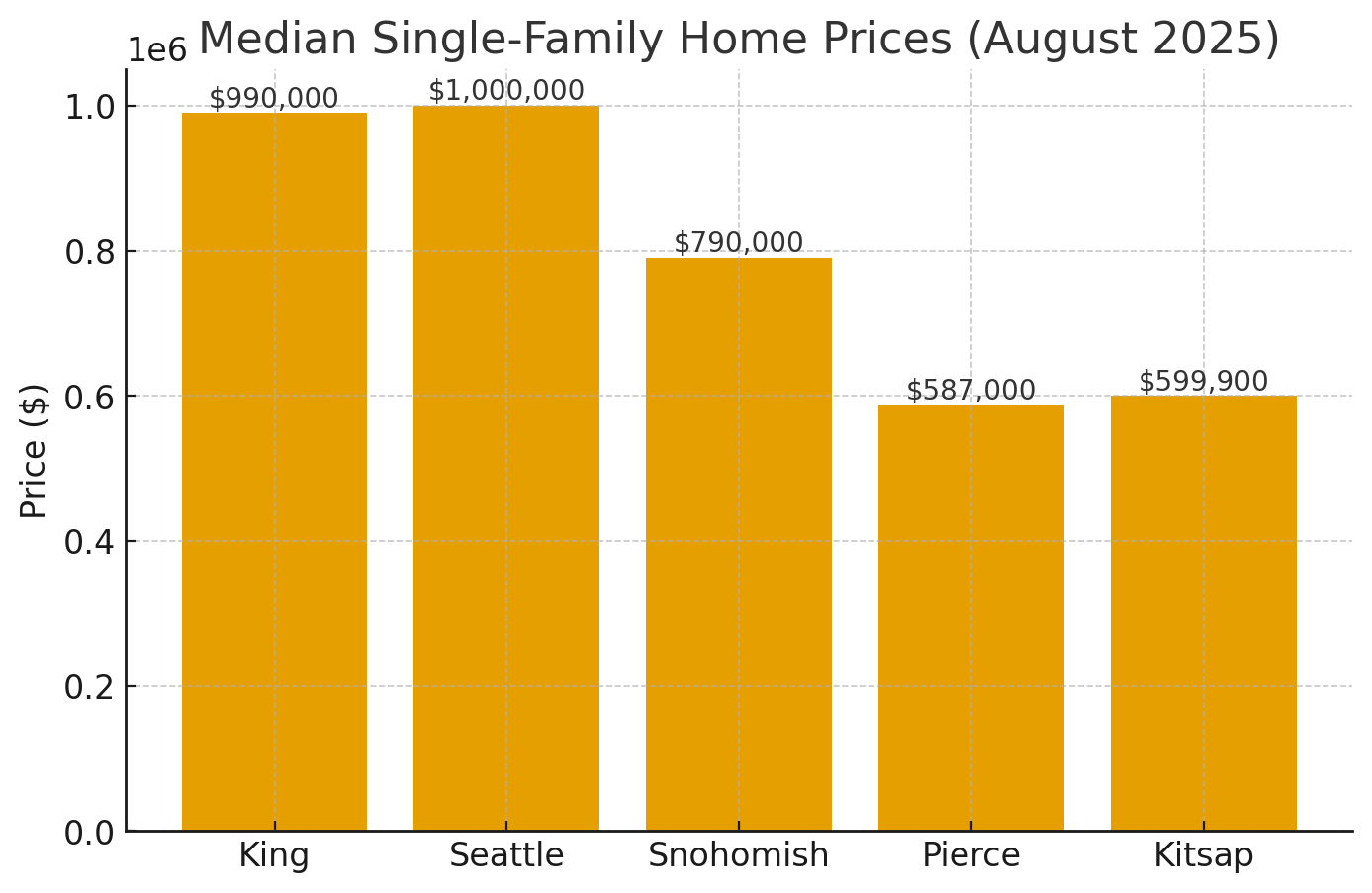

Detached single-family homes continue to dominate demand, largely due to their scarcity relative to condos and townhomes In August:

King County: Median single-family price ↑3.7% year-over-year to $990,000.

Seattle (within King): Median price hit $1,000,000, a 7.5% increase.

Pierce County: Median price ↑1.2% to $587,000.

While new listings declined in King County (2,088 in August vs. 2,242 last year), active inventory rose 31% year-over-year, suggesting longer market times for certain homes.

Our Single Family Sales This Summer

Condos and Townhomes: Higher Prices, Slower Sales

Condo prices are climbing, but demand is less intense than for single-family homes. NWMLS data shows:

King County condos: Median price ↑5% to $549,000.

Seattle condos: Median price ↑7% to $595,000.

Despite these gains, elevated mortgage rates above 6.5% and increasing HOA fees have made condos less attractive, particularly to first-time buyers comparing costs to renting.

Our Condo and Townhome Sales This Summer

Market Velocity: Divergence in Sales Speed

Median time to pending in Seattle: 23 days, reflecting strong demand for well-priced homes.

Median time for unsold active listings: 48 days, signaling resistance to overpriced or poorly marketed properties.

This divergence illustrates a “bifurcated market” where attractively priced, move-in ready homes move quickly, while others stagnate.

Buyer and Seller Dynamics

For buyers: Rising inventory in King (+31%) and Snohomish (+50%) counties expands negotiating leverage, though affordability remains constrained by interest rates.

For sellers: Strategic pricing is essential. Homes priced slightly below expectations often trigger multiple offers, while ambitious pricing risks extended time on market.

Outlook: Hot, But Selective

Detached homes remain highly competitive due to scarcity.

Condos/townhomes face slower absorption despite notable price increases.

Interest rates above 6.5% and affordability challenges could temper demand into fall, though limited supply continues to place upward pressure on prices.